EV Charging Station Credit

The EV charger credit, formally known as the alternative fuel refueling station credit, has been extended through 2032. The credit is available for both individual and commercial uses to help cover the cost of charging stations.

- For individual/residential uses, the tax credit covers 30% (up to $1,000 per unit) of the cost of the equipment

- For commercial uses, the tax credit covers 6% (up to $100,000 per unit) of the cost of the equipment

- Bidirectional charging equipment is eligible

- 2- and 3-wheeled vehicle equipment is eligible

- Starting after 2022, equipment must be placed in a low-income community or non-urban area

Visit the

Alternative Fuels Data Center for more information on the credit.

Frequently Asked Questions

Below we’ve compiled a list of questions and responses on the credits summarized on this page. We will update these FAQs as more guidance becomes available from the federal government. We encourage you to continue to check this page.

EV Tax Credit for New VehiclesHow do I know if my vehicle is eligible for the federal tax credit?You can check if a vehicle is eligible for the current tax credit on the

Department of Energy website (the site lists all vehicles that

should be eligible for the credit.). To check if your vehicle is eligible, you will need the Vehicle Identification Number (VIN) which you can enter into the VIN decoder on this

website (scroll to bottom of page to access VIN decoder).

If you purchase a vehicle before the end of 2022, it should be eligible for the credit if:

- final assembly of the vehicle took place in North America and;

- the manufacturer hasn’t yet hit its 200,000 vehicle cap.

Check the

Department of Energy website above for a list of these vehicles. At this point, we’re unable to confirm which vehicles will be eligible starting in 2023. We expect more information on that will come.

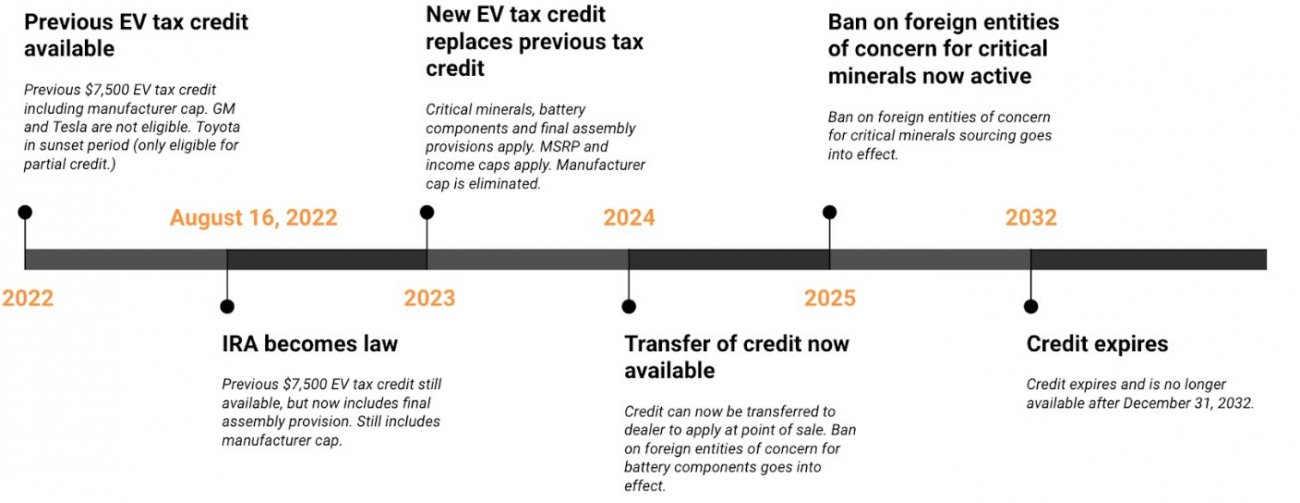

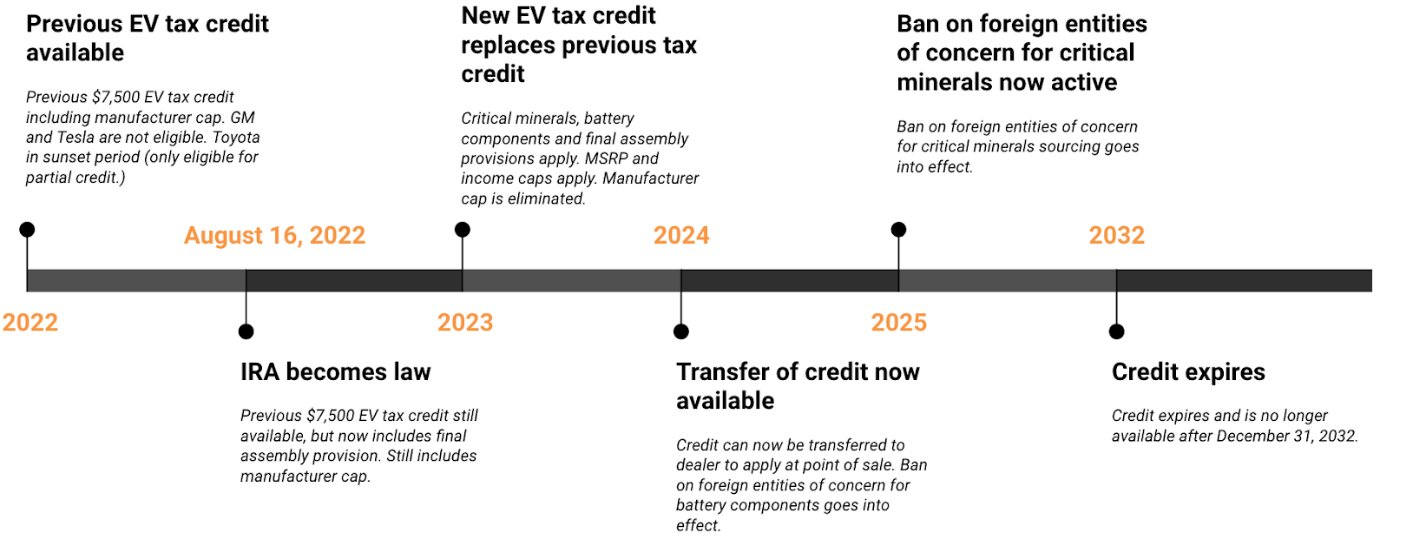

If I already took delivery of my EV in 2022, am I eligible for the tax credit? If you took delivery before August 16, 2022, you are eligible for the tax credit under the previous conditions. The main restriction under the previous tax credit is the manufacturer cap.

I ordered an EV this year, but don’t have a binding purchase agreement. Will I still be eligible for the old $7,500 tax credit? Your eligibility for the old $7500 tax credit depends on whether you took delivery of the vehicle before August 16, 2022. If you took delivery before August 16, 2022 then you are eligible for the previous credit. If you take delivery of the vehicle after August 16, then the final assembly provision applies. This means that the vehicle must undergo final assembly in North America to be eligible for the credit (see vehicle list

here).

Can I get a written binding contract to secure the credit? Not anymore. Consumers who acquired a “written binding contract” to purchase a qualified EV before the Inflation Reduction Act became law (on August 16, 2022) will be able to apply under the previous tax credit requirements.

Are plug-in hybrid vehicles eligible?Yes. A qualifying plug-in hybrid vehicle must be propelled to a significant extent by an electric motor that draws electricity from a battery, and which has a capacity of not less than 7 kWh, and is capable of being recharged from an external source of electricity. Plug-in hybrid electric vehicles must also meet the final assembly requirements and must be manufactured by an automotive company that hasn’t met its cap (see list

here).

How will “SUV” be defined? Are the Tesla Model Y and the Mustang Mach-E SUVs? The classification system is still in development for the EV tax credit. The size and class of vehicles will be determined using similar

criteria to those currently used by the Environmental Protection Agency and the Department of Energy.

Is the tax credit available for leased vehicles? Yes, the credit applies to new purchased, financed and leased vehicles after December 31, 2022 through December 31, 2032.

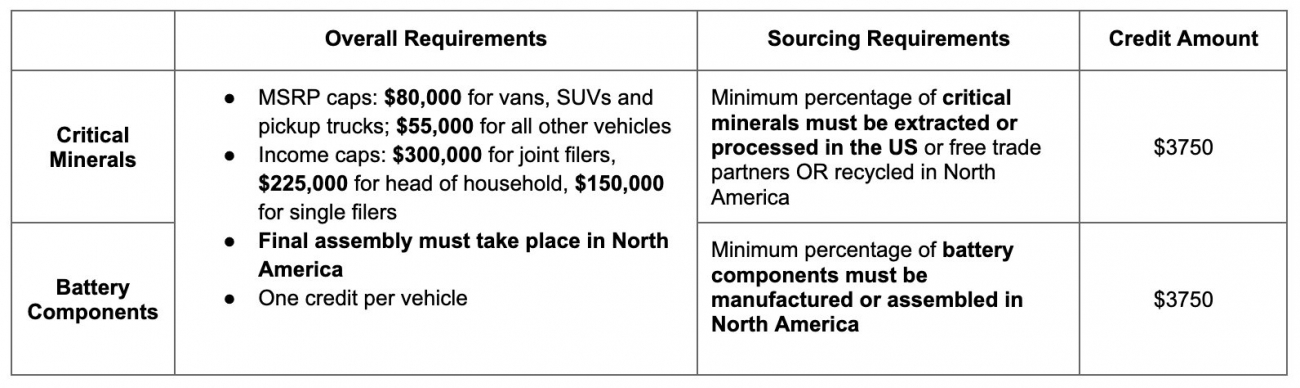

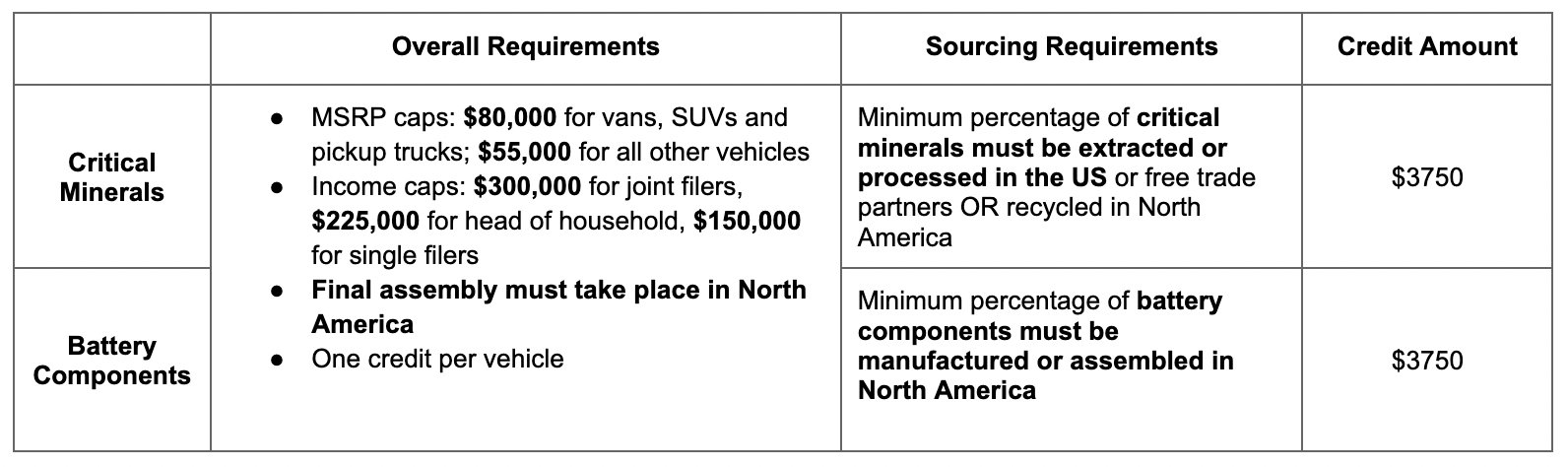

Will I receive the full $7,500 for my vehicle? Starting in 2023, the new credit is split into two pieces. In order to receive both halves, a vehicle must fulfill all the requirements for each half. Even if the vehicle does not meet all the requirements, it may be eligible for half of the credit.

How is the income cap calculated? Income will be calculated by “

modified adjusted gross income” which is a calculation from your Adjusted Gross Income and includes or excludes certain deductions and income. Modified adjusted gross income is used in a variety of places like calculating eligibility for health care or retirement deductions. Eligible consumers must fall at or below the following income caps:

$300,000 for joint filers or surviving spouse

$225,000 for head of household

$150,000 for single filers (and others not included in joint filers or head of household)

How will my income be verified to ensure I qualify for the credit? The income caps will only apply starting in 2023. Unfortunately, we’re not certain how this will be done yet. The IRS is responsible for developing the program to process credits and has been directed to create guidance on the program by the end of 2022. The income verification process should be included in their released guidance.

How is the MSRP (manufacturer’s suggested retail price) cap calculated? Does it include optional packages or after-market add-ons? We don’t know yet if MSRP in the context of the credit will be calculated with options or just be based on the price from a vehicle’s window sticker. The IRS is still developing guidance on this and we will update our information as soon as confirmed answers are available.

How can I apply the credit at point of purchase? Starting in 2024, the credit can be applied at point of purchase to “take money off the hood.” Buyers will be able to do this by “transferring” the credit to a registered dealer. The IRS is developing guidance and a program to process the credits at point of purchase and we expect more information will be provided in 2023 on how the process will work.

I’m retired. Am I still eligible for the new tax credit if I don’t have a taxable income?The best thing to do in this case is to lease the vehicle and have the automaker’s finance group take the credit and pass it through as a reduced lease cost over the term of the lease. This can be a good deal in general because you can get the full credit on a lease over a shorter period of time and lower cost.

Are 2- or 3-wheel vehicles included in the EV tax credit for new vehicles? The tax credit is designed for 4-wheel vehicles. Unfortunately, 2 and 3-wheel vehicles are not eligible.

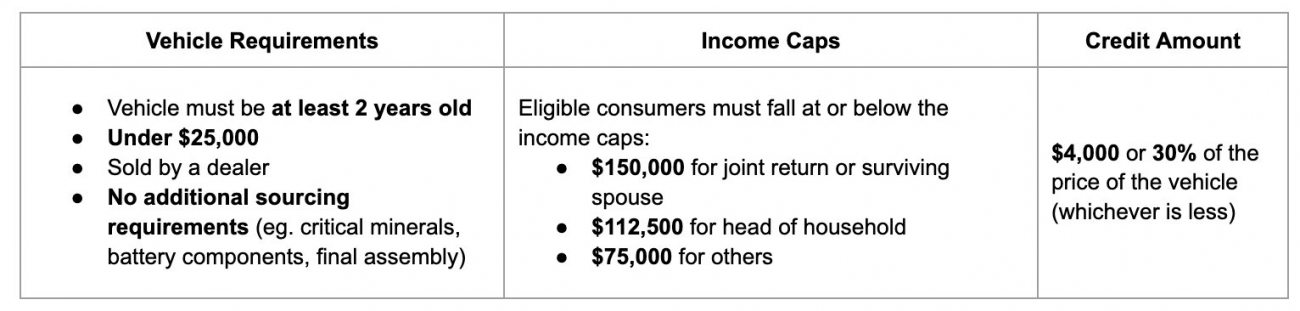

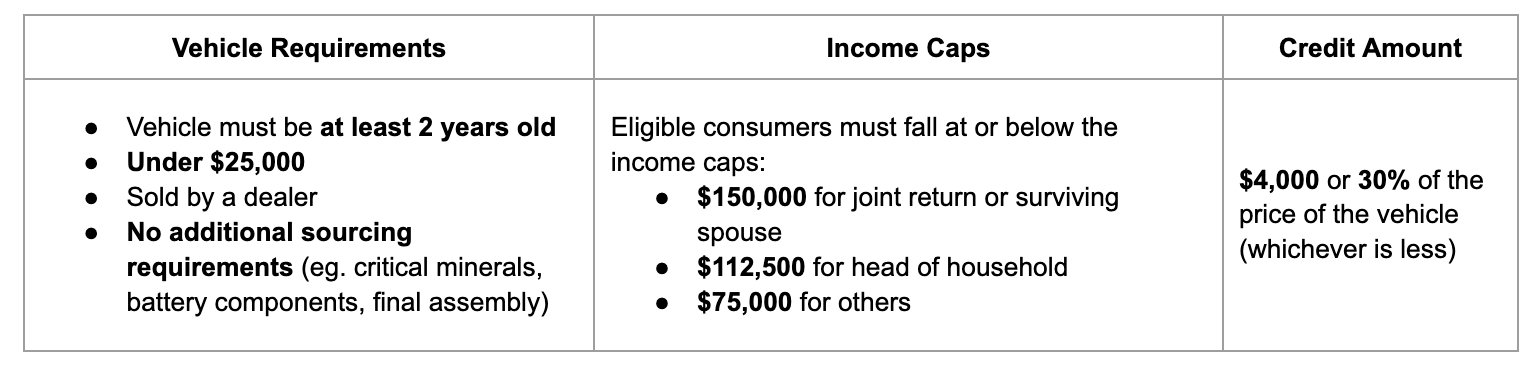

EV Tax Credit for Used Vehicles

If a vehicle has already received a tax credit when it was purchased as new, is it eligible for the used tax credit? Yes. A vehicle is limited to one credit per vehicle for each type of credit meaning that a vehicle can receive the tax credit as a new vehicle and again as a used vehicle for a different owner.

Do used vehicles have to meet the battery components and critical mineral requirements? No, used vehicles do

not have to meet critical minerals or battery components requirements. The requirements for used vehicle eligibility include:

- Model year must be at least 2 years old

- Must be sold by a dealer

- Must be under $25,000

- Can only apply once to each vehicle

How can I apply the credit at point of purchase? Starting in 2024, the credit can be applied at point of purchase to “take money off the hood.” Buyers will be able to do this by “transferring” the credit to a registered dealer. The IRS is developing guidance and a program to process the credits at point of purchase and we expect more information will be provided in 2023 on how the process will work.

IRA Webinar: What is the IRA and how does it affect federal EV tax credits?

Plug In America recently hosted a webinar that explains the upcoming changes to the federal EV tax credit. This webinar is geared toward those interested in learning about the changes to EV tax credits as a result of the IRA. It was hosted by Plug In America’s Policy Manager, Alexia Melendez Martineau, and Senior Policy Advisor, Jay Friedland.